Low Rates

Affordable Loans

Expert Guidance

Veteran Owned & Operated Small Business

No credit check. No obligation. No. B.S.

100% confidential.

We use A.I. to keep costs low. Savings passed on to you. (In progress now)

Helping families create generational wealth through real estate.

It starts at home.

Buying a Home

I need a pre-approval

Highlights:

Get expert guidance

Know how much home you can afford

Strategize the financing plan

Including down payment options

Partnering with your realtor get your offer accepted

Verified Approvals - make your offer almost like cash

Refinance

Lower Payment or Cash Out

Highlights:

Lower your monthly payment

Low rate

and/or better terms

Tap into your home equity and cash out

Pay off high interest debt

Leverage for new investments

Switching loan type and features for your benefit

Loan Programs

There's a few... But, don't worry!

We help you find the best program at the lowest rate.

Jumbo Loans

For loan amounts above Conventional, FHA, or VA county limits

Min. FICO 660

Home Equity Loan

A form of cash-out

Fixed 2nd mortgage against home equity

Great choice for those with already low rates looking to cash out

Down Payment Assistance

Options:

Soft 2nd (loan)

Grants

Local / State Programs

Must qualify in FHA or conventional guidelines

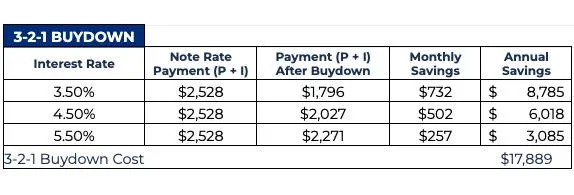

Temporary Rate Buy Down

3-2-1 example provided

Funded by other parties: seller concessions, agents, bank option

Up to 3 years temporary rate buy down

If refinanced at a lower rate before the end of the buy down, fund is REFUNDED to you.

Don't know which program is best for you?

No problem!

Simply, request a quote and we'll help you.

No credit check. No obligation. No. B.S.

100% confidential.

From RENTING to OWNING in 5 simple steps!

Owning a home is easier than you think! With our straightforward guidance, you're just steps away from your dream home. Let us guide you through every stage of the journey.

5 simple steps to homeownership!

We help you navigate through everything else, so you don't worry.

Step 1:

Schedule a call to get pre qualified and get a quote.

Step 2:

Get a written pre-approval or verified approval.

Step 3:

Work with your realtor for properties within your parameters and submit offers

Step 4:

Go through inspections and loan processing

Step 5:

Sign documents & close, get keys, become homeowners.

Home Loan Programs

VA Home Loans

As low as 0% Down Payment

Low or no credit score required

Lowest rates

No mortgage insurance ever

Easy streamline refinance option

Conventional Home Loans

Down payment options as low at 3%

Mortgage Insurance may be required up to 20% down payment

Removable mortgage insurance

Lowest monthly payment

Credit scores starting at 620

Ideal for borrowers with good credit and down payment

FHA Home Loans

Ideal for most first-time home buyers

Only 3.5% down payment required

Down payment assistance option available

Streamlined refinance option available

Credit scores starting at 580

Jumbo Loans

For loan amounts above Fannie, FHA, or VA county limits

Renovation Loans

Conventional - Fannie Homestlye Loan

FHA - 203k Renovation Loan

VA - VA Renovation Loan

All the same qualification with the renovations built into one single easy loan

Learn More:

No Doc Loan (Stated Income)

Currently not available

Learn More - No Doc Loans

Bank Statement Loan

12-24 months bank statement for income deposit verification

No tax returns required

No W2 or 1099 required

Options as low as 15% down payment

Credit scores starting at 660

Learn More - Bank Statement Loan

Investor DSCR Loan

Debt Service Coverage Ratio

Possible no ratio loan

As low as 20% down payment

No tax returns required

No W2 or 1099s required

Credit scores as low as 660

Reserves required

Learn More - DSCR Loan

P&L Only Loan

Profit & Loss Loan

CPA certified P&L provided as income

Down payment as low as 20%

Minimum credit score 680

Reserves required

Learn More - P&L Only Loan

Foreign National ITIN Loans

Coming soon - Please inquire.

Learn More - ITIN Loans

1099 or W2 Only Loans

1099 Statements only

Learn More - 1099 Only Loans

Asset Utilization Loans

Credit scores as low as 660

Assets used as income

20% down payment required

Income formula below

Monthly Income = Total Asset / 60 months

Learn More - Asset Utilization Loans

Reverse Mortgage / Reverse Purchase

Retire comfortably with a reverse mortgage! Get rid of an expense, or have some extra cash for retirement. Enjoy the home without the stress.

Must be 62 years and older

No monthly payment

Cash out option

Monthly stipend option

Primary home only

Learn More - Reverse Mortgage

Down Payment Assistance

Options:

Soft 2nd loan

Local / State Programs

Work with a lender & realtor to identify local programs

Learn More - Down Payment Assistance Programs

Temporary Rate Buy Down

Interested parties to contribute towards buyer's rate buy down:

Interested Parties:

Seller concessions

Buyer/seller agent credit

Lender option may be available

Example: 3-2-1 temporary rate buy down means:

If original rate is 7%

1st year rate is 7% - 3% = 4%

2nd year rate is 7% - 2% = 5%

3rd year rate is 7% - 1% = 6%

4th year rate is 7%

NOTE: Buyer must qualify at the 7% rate BEFORE the temporary buy down

Purpose on this is to help the buyer make the payments more affordable while banking on future rates to drop for a refinance.

Remaining balance on the temporary rate buy down belongs to the buyer.

Contact us for more details

How to Get Approved

Connect with one of our veteran loan officers to help get you pre-approved.

Down Payment

As low as:

0% with VA Loan

3.5% with FHA loan

5% with Conventional

Credit Score

Credit Scores starting at:

500 with VA Loan

580 with FHA Loan

620 with Conventional

Employment History

2 years working history

Some exceptions may apply. Please, talk to a loan officer to find out.

Debt-to-Income Ratio

VA Loan - up to 65%

FHA Loan - up to 57%

Conventional - up to 50%

We have additional loan products that can help the unique borrower.

What Customers Say About Us

Our Team

David Tran, BROKER

Army Veteran, MBA

Jeanette Nguyen

Loan Officer

Carlos Urbina

Navy Veteran | Loan Officer

Home Wealth Check

Track your home wealth. Save more money. Build wealth faster.

Copyright 2024 . All rights reserved

Equal Housing Opportunity © 2024 Apache Mortgage Inc, 14098 Edwards St, Westminster, CA 92683, 949-298-2980. NMLS ID # 2454357 DRE # 02209550 & 02031005. For licensing information go to www.nmlsconsumeraccess.org. Trade/service marks are the property of Apache Mortgage Inc and/or its subsidiaries or affiliates. Information is intended solely for mortgage bankers, mortgage brokers, and financial institutions. For more information, review Apache Mortgage Inc's state licenses and important notices. Co-op loans not available. Some products may not be available in all states. Information, rates and pricing are subject to change without prior notice at the sole discretion of Apache Mortgage Inc, Mortgage Broker. All loan programs are subject to borrowers meeting appropriate underwriting conditions. This is not a commitment to lend. Other restrictions apply. [05-2024]

Privacy Policy and Reg P.